Similar to the way people insure their cars, houses, and lives, slave owners would sometimes insure their slaves. Fearful of not getting their money’s worth from their slaves, owners would sometimes take out insurance policies on them.

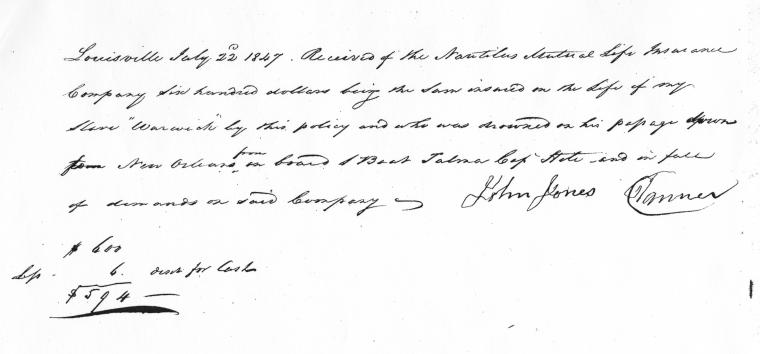

In the 1800s, for example, some slave-owners who rented out their slaves would insure them so that, in the event, their slaves died or were severely injured in the hands of someone else, the owners would not suffer too much of an economic loss, according to The Treasury of Weary Souls.

The Treasury of Weary Souls, created by New York University Professor Michael Ralph and engineers from Resilient Coders, examines what slavery looked like after the trade was outlawed in 1808, but continued to exist via the smuggling, breeding and renting of slaves within the United States. Ralph spent a solid seven years researching slave policies, and when it came time to share it with the world, he hired a handful of coders from Resilient Coders.

Resilient Coders is a nonprofit organization that trains people of color for jobs in the tech industry as software engineers. The Bootcamp trains people of color for 14 weeks in semantically structured HTML, responsive CSS, JavaScript, jQuery, git and more.

For the last year or so, a handful of Resilient Coders worked with Ralph through the concept, design and the ultimate creation of the project, which utilized JavaScript data visualization tool D3.js. The project was spearheaded by Resilient Labs’ Muigai Unaka, a lecturer at Northeastern University.

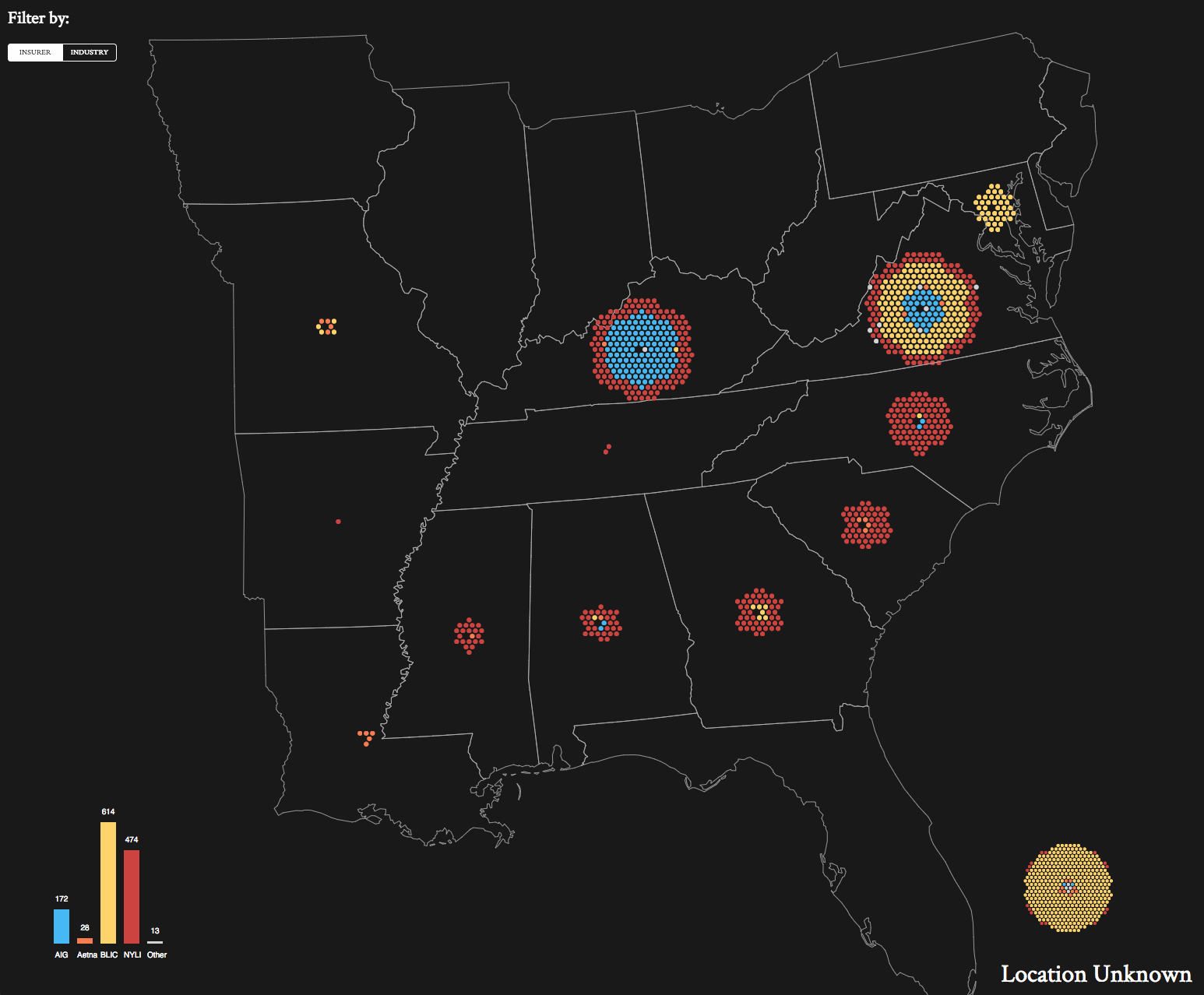

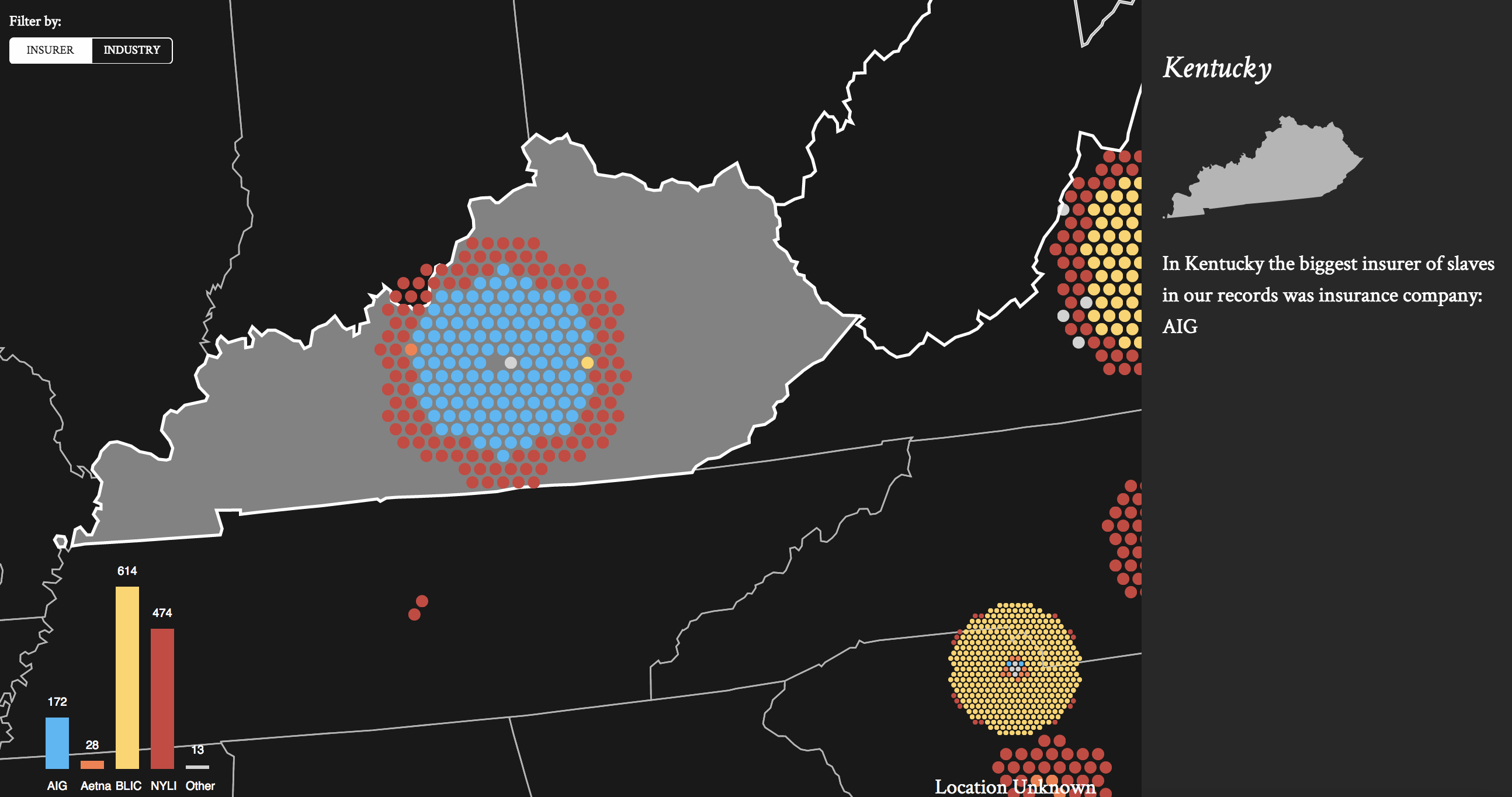

Map of insurance policies taken out on slaves

As Ralph’s research shows, slave owners sometimes relied on financial firms like Aetna, AIG, and New York Life Insurance to insure the slaves whose skills were highly valued. In Alabama, New York Life, which was known as The Nautilus Insurance Company at the time, was the largest slave insurer, according to the Treasury of Weary Souls. Between 1845 and 1848, NYLI sold policies to slaveholders to insure their slaves against damages or death.

By the 1840s, the number of slaves insured in the South was about the same as the number of free whites with life insurance, according to Ralph. Of that number, however, Ralph said he never saw a plantation slave insured in his seven years researching 1,300 policies.

“Even though plantation slaves were valuable in the marketplace, they were never insured,” Ralph said. “They were viewed more like livestock. They enhanced the value of the plantation but their skills weren’t seen as valuable or premium.”

Insurance policy for a slave, Warwick.

Instead, slave owners would insure coal miners, blacksmiths, carpenters, railroad workers and other slaves with valued skills. Miners, for example, made up 15.4 percent of the insured slave workforce, according to the project. Steamboat workers accounted for 12.6 percent of those insured and domestic workers accounted for 14.6 percent of the insured slave population, according to the ledger.

In January 1855, a slave owner by the name of Thomas Doswell insured seven slaves to work in the coal pits in what is now West Virginia. Two of the older slaves were insured for $500 each and the younger ones were insured for $700 each. In 1855, the average price for a slave was $600, according to Ralph’s research.

Ralph says the Treasury of Weary Souls is the most comprehensive ledger of skilled slaves who built America. In his research, Ralph said he found these slaves had more mobility than plantation slaves. Sometimes they were able to negotiate their work schedules and other terms of forced labor, he said. The market for slave insurance was mostly in urban areas.

“On one hand, this is about a new tier of slaves who emerged in the last decades of legalized slavery who were more elite,” Ralph said. “There were ways in which they were more valuable even though they were less free than free white people.”

Ralph’s research is based on data from the California Department of Insurance, Slavery Era Insurance Registry, Illinois Department of Insurance, Slavery Era Insurance Policies Registry and other sources. The archives are incomplete but Ralph says his evidence suggests at least 85 percent of policy records may have been lost.

In his upcoming book, Life: Slavery and Insurance in US History, Ralph explores how the life insurance industry took off as slavery was drawing to a close. He argues the slave insurance industry helped establish the life insurance industry for free citizens. At the time, Americans were skeptical of placing a monetary value on a life, he said.

“With urbanization, more people started to become open to the idea of finding some way to insure against potential loss of income if they happen to pass away,” he said. “The industry of slave insurance created the appreciation for what that mechanism can do.”